The one thing that is constant is that I am consistently improving the software in response to customer feedback, as well as a result of my own daily use of the tools.

As a result of feedback from one of customers who is a HomeVestors franchisee and performs a high volume of ARV assessments, there are several new calculations that have been added to the ARV calculator.

These calculations should help you reason much more effectively about the potential value of your real estate even more in line with appraisal best practices, especially when performing a sales comparison analysis and adjusting your comps in the tool.

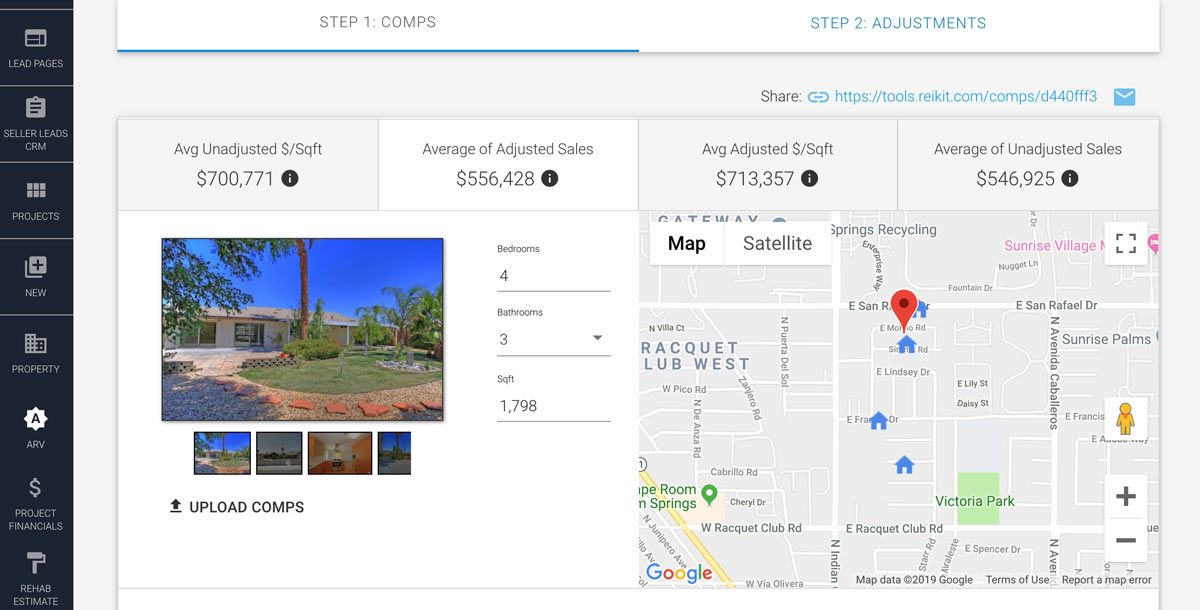

There are now 4 calculations shown for the ARV that depend on whether you are adjusting the values or not.

The available ARV calculations are:

- Unadjusted ARV using the average of comp $/sqft

- Adjusted ARV using the average of adjusted comp sales

- Adjusted ARV using the average of adjusted comp $/sqft

- Unadjusted ARV using the average of comp sales

Only the first two ARV calculations are automatically selected for you by the software depending on whether you adjust your comps or not. The other ones are provided for reference.

After Repair Value for Unadjusted Real Estate Comparables

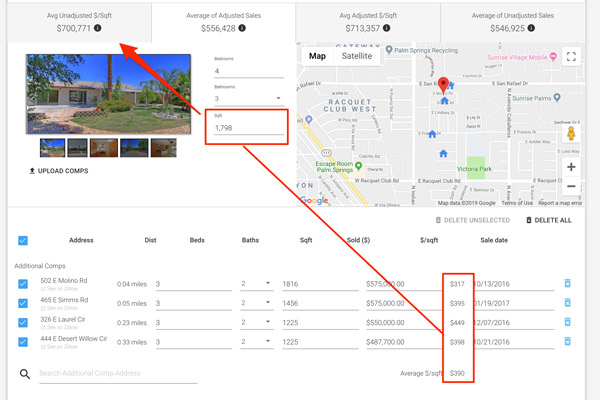

In determining the ARV of real estate using unadjusted comps, the software uses the average of the selected unadjusted comps’ $/sqft and multiplies it by the square footage of the subject property.

This is the default calculation selected for you when you first run a comparable report, given that you have not adjusted your comps yet.

Although I don’t recommend that you use the ARV estimate tool to come up with an automated valuation for your real estate, and conversely I do recommend that you perform a full sales comparison analysis adjusting your comps, nevertheless, getting a quick approximate value with unadjusted comps is a useful part of your initial analysis to see if it is even worth putting in the effort.

This calculation is much more useful for unadjusted comps as opposed to using the average of unadjusted comp’ sales amounts, as it will normalize the value of your property according to it’s size, and the average of the size values of properties surrounding it.

This means that if your comps are not of similar sizes, or if your property is not similar in size to the average comp, those differences will get reduced to give you a closer estimated after repair value.

Of course the bigger the differences between the comp’ sizes and sale amounts, the less confidence you should have in the final number.

This is why you should always rationalize your comps selection in terms of date sold, distance, similar sizes, similar finish, and of course also adjust for the differences between them to come up with the adjusted value.

Adjusted After Repair Value Using Adjusted Real Estate Comparables

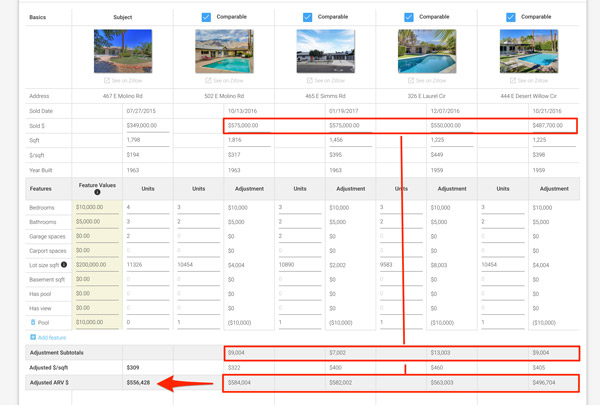

If you perform any adjustments in values of your comps, the software will automatically default to using your adjusted ARV value for your real estate deal analysis.

In determining ARV using adjusted comps, it is calculated using the average of the adjusted sales prices of the comps, by first adding and removing feature adjustments to each comp’s sale price according the values of the features that you entered.

This ARV calculation follows appraisal best practices much more closely than the unadjusted one, whereby having performed the thorough analysis to reduce any differences between properties, the adjusted sales prices can now be used determine the potential value of the property.

The Other Two ARV Calculations Are For Reference

The other two calculations are the adjusted and unadjusted complements of the explained calculations. These should not be used for determining value, and only referred to for a sanity check.

For example, if your ARV based on sales prices is much different from your ARV based on $/sqft, that could indicate that the size of your property is too different from the average size of your comps, reducing the confidence that you should have in your analysis, and letting you know that you might have to select different comps that are closer in size to your subject property.

Summary

Your requirements will determine the most appropriate ARV calculation to use in the ARV calculator, whether you use the free ARV calculator which uses Zillow data for demonstration purposes, or the paid version of REI/kit real estate investment software.

The paid version of REI/kit uses much more accurate comps data and proprietary comps selection algorithms that will blow any cheap or free software based on Zillow data out of the water.

Using either tool, if you are looking for a quick estimate of after repair value, then you can use the unadjusted ARV calculated using average comp $/sqft to understand how your property compares to the average of other properties around it.

If on the other hand you’re looking for an accurate appraisal like estimate of value, then you can also do that by adjusting your comps for their differences in using the sales comparison analysis tool under the adjustment tab. This will return the average of the adjusted sales prices of the comps.