In this guide to choosing the best house flipping software, I aim to help you in your decision process by talking about the most important aspects necessary to scale your business, and then talk about the features of software that you might need in order to get there.

There is actually significant overlap here between software for house flipping and real estate wholesaling, and for good reason: The hard work is on the front end, before you even offer on a property.

With this guidance, I want to truly help you make an educated purchase decision in the goal of making your business successful.

What is the best house flipping software?

The best house flipping software is software that helps you with the most important aspects of scaling your real estate investment business: lead flow and deal flow.

If you are looking online for real estate flipping software, or a real estate investment app, you may be wondering how to choose from the many software providers that are available.

So many choices, so much hype …

Many real estate investment apps claim to offer similar features, although unfortunately due to the nature of this business, there are also many exaggerated claims out there. This requires looking much more closely under the hood of each software to determine where the value lies, and usually, it’s correlated to price and data.

Since you can’t get something of value for nothing, the old adage of: “you get what you pay for” applies here as well, and if you pay very little or nothing for your software, you should expect to get nothing of true value in return.

But it doesn’t always work this way, and sometimes you end up paying for hype.

Yes there’s plenty of PT Barnums out there, and their hyped up “all-in one software” that says it does everything.

This unicorn does not exist, unfortunately. If it did, it would cost you tens of thousands of dollars and none of us would be able to afford it.

I wrote this guide specifically to help you navigate all of the claims out there and to help you think about how to choose the software that you need based on what is important for scaling your business right now.

This means that depending on what you need, REI/kit might not be the right fit for you.

With that end in mind, I created this additional companion spreadsheet to help you think about how to evaluate your needs and choose the best house flipping software.

Additionally, with this guide I hope to prevent you from making the classic mistake that most people make, whereby they choose software based on what they think they might need in the future, solving a business problem that they don’t actually have yet.

This mistake is called premature optimization and is huge waste of your time at a critical point in your business, when scaling toward sustainability is what matters.

So let’s begin.

First define the TRUE problem that needs solving

Before you can evaluate the best software for house flipping and real estate wholesaling, you first have to ask yourself the following question:

Are you trying to build and scale a sustainable business?

If that is your end goal, then if you are house flipping, 90% of your problems that you need to solve for in order to build your business can be split into the following 2 categories:

1) Lead flow with Inbound leads

2) Deal flow:

If your are house flipping that means: Securing funding

If you are wholesaling that means: Securing buyers

Until you have enough flow for both of these, you do not have a viable business, and unless you focus all of your energy on solving those two problems, you might as well pack your bags and go home.

Everything else including project management, and vendor management are just execution details to be optimized only after you have completely and systematically addressed your lead flow and deal flow.

Therefore if your software for flipping or real estate wholesaling does not help you with these two problems, then the software is solving the wrong problems for you.

Why REI/kit House Flipping Software does not include Project Management

Should house flipping and real estate wholesaling software have a project management component?

Not in my opinion.

The Short Answer

The short answer is that house flipping software should be used for deal management, and when you’re in the construction phase then there is already best in class project management software out there, that solves the project management, cost management, and vendor contact management needs, which is used by most successful project managers in the construction industry:

Buildertrend is by far the best software out there for managing construction projects which is why it’s used by most successful construction professionals.

The Long Answer

And the long answer is that before you start looking for project management software you should ask yourself, whether you’re solving for the right problem in the first place.

Are you working in your business or are you working on your business?

If you’re doing it right, then you’re working on the business which means optimizing your lead funnel, closing deals, and pitching your next financing partners.

Why?

Because those activities will always be your limiting factors when house flipping.

Similarly if you’re wholesaling real estate your second limiting factor is getting your deals to your buyers.

If you have more deals than you have financing to execute on them, then you need to find more funding partners or more buyers.

If you have more financing than deals to take advantage of the pool of available money, then you need to spend 100% of your time finding new deals. Nothing else.

So if you’re only doing 1-5 deals at a time you should probably stop worrying about project management software.

You have not yet accomplished your number one job as CEO to make this a sustainable business: to fill your deal pipeline.

Think about it another way: Say it takes 1,000 leads to make 10 offers to execute on 1 project that will make you $20,000. How many leads do you need to contact, nurture, and convert to make a modest $100,000 this year?

5,000 leads will only bring you only $100,000 in profits, and this is still before paying yourself.

In this scenario, even with 5,000 leads your business has not reached long term sustainability.

Do you have at least 5,000 leads in your CRM right now?

No?

Then stop looking for project management software and get back to finding and managing leads.

Yes?

If you HAVE scaled your business and are doing more than 10 deals at a time because you have solved getting enough qualified leads, and you are choosing your deals wisely to ensure profit margins in these tough times, then congratulations:

You now do not have time to manage the day-to-day of what your sub-contractors are doing in project management software.

That would be a supreme waste of the value that you bring to your business, and would be detrimental to its growth.

Instead, at this point you should have outsourced your project management to professionals who already use their own tools and report to you the status of the project, so that you can do what?

Hire people to bring in more leads, and network more to find more financing.

For those reasons we don’t offer project management as part of the software.

Best Construction Project Management Software Recommendations

Now if project management IS your problem, then you should not be looking for house flipping software. You should be looking for best in class construction project management software, and I have some recommendations for you depending on the size of your business.

Best Construction Project Management Software for House Flipping

Defining The Solution

So let’s talk about the ways that you might solve 90% of your problems when scaling your house flipping business.

Ask yourself:

Do I have more leads that I can handle?

No?

Your number 1 priority is to figure out lead generation. Do this with inbound warm leads via a lead generating website, pay per click advertising, and outbound direct response marketing to lead lists.

Am I managing my lead follow up and marketing?

No?

Then your number 1 priority is to figure out lead management and marketing.

Am I 100% sure that my profit margins are defensible via extensive deal due diligence?

No?

Stop using software that relies on incomplete Zillow data to make decisions worth hundreds of thousands of dollars and spend a few hours not minutes making your due diligence rock solid so that you have proven beyond any doubt that you should do the deal, or that it can be financed, or sold.

Am I confident that if I can come up with the next deal that I can get it funded or sold?

No?

Make your deal pitch rock solid based on great data showing all of the data points necessary to prove that the lender should underwrite the deal.

Your selection of house flip software and real estate wholesaling software should reflect these most important problems of your business.

It really is that simple. Unfortunately it’s not particularly sexy, when we would rather be picking out tile and counters at Home Depot.

But this is where the most important work is.

Only if you have your lead funnel solved, should you start thinking about optimizing other parts of your business such as your suppliers, and growing and managing your team.

The House Flipping Software Evaluation Process

So how should your software help you get from Inbound Leads to Funded or Sold Deals?

Step 1: Lead Generation

Are you getting enough leads?

If not, then start with warm motivated seller leads first captured by a high converting investor website.

Real Estate Investor Websites for Warm Lead Capture

Where do people who are looking to sell their house find you?

Where they are looking: on Google, period.

Before you do anything, make sure that you have published a website to capture online motivated seller leads.

Since ranking in Google can take at least 3-6 months, the sooner you do this, the sooner you can get started ranking for the terms that are important to you for eventual free motivated seller leads.

You lose 100% of the shots you don’t take, and so if you don’t have a website, you will lose out on 100% of the searches by these motivated sellers.

Poor Quality Software

Does not have any way for you to capture these leads or integrate with any other lead generating website.

Better Quality Software

Better quality house flipping software may not have the ability to create a website, but may at least integrate with an external website that captures motivated seller leads.

Best Software

Has an integrated high converting SEO optimized mobile and secure website that captures warm motivated seller leads from online searches and PPC advertising funnels.

The REI/kit solution

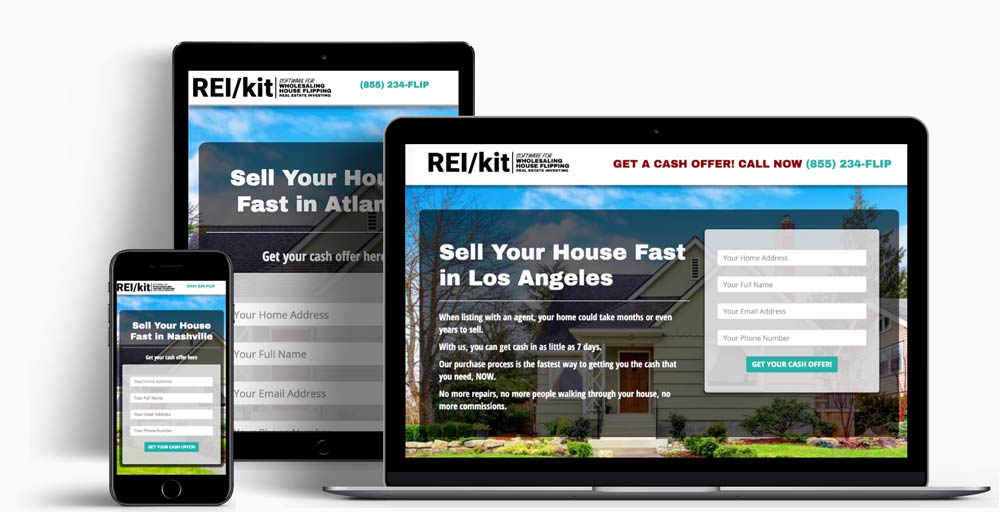

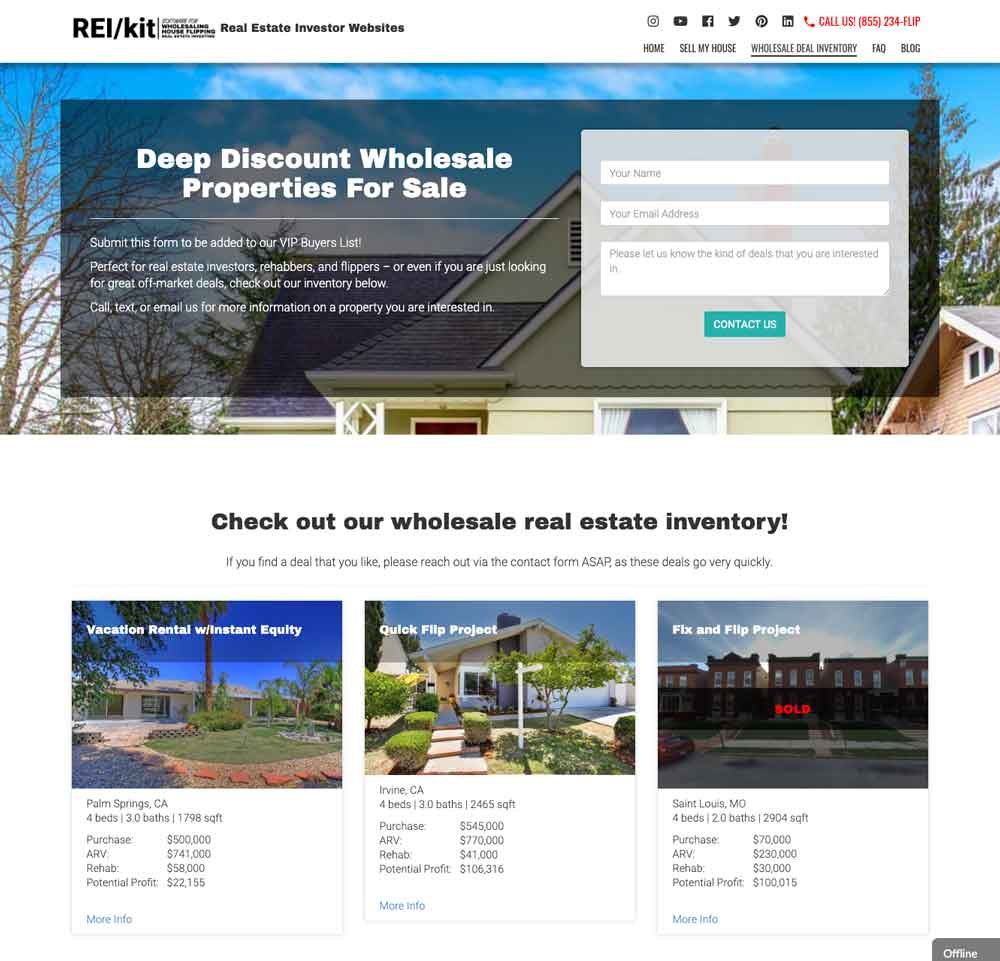

REI/kit offers you the ability to generate a secure, SEO optimized, mobile friendly real estate investor website in a matter of a few clicks.

You can cut to the chase and reduce the time to get started from months if you were to try to build one from scratch, down to minutes when using the REI/kit website generator with content designed to help you rank in Organic search results as fast as possible.

The other important component of REI/kit investor websites is the deep integration of the website with the rest of the real estate flipping software.

That means that any leads that come in through your website, you can immediately act upon using our extensive suite of due diligence tools and supporting data to really understand who the owner is, what they might owe on their house, and how much it might appraise for.

Want to speed up lead generation? If you are an advanced online marketer, you can build squeeze pages within REI/kit websites to drive paid online traffic of motivated seller leads.

In about 2 clicks, your lead generating investor website can look something like this: https://www.reikit.co

So for the same price of one carrot site that’s not integrated with anything else, you could get a REI/kit site that’s better in many ways, plus a CRM, text, ringless voicemail and email marketing automation, plus the suite of extensive due diligence tools. 10 tools for the price of one.

3rd Party Lead List Import

Poor Quality Software

Does not have any way for you to add external lead lists into the software or manage your lead information.

Better Quality Software

Better quality house flipping software will allow you to upload your lead lists into its CRM.

Best Software

This software may directly integrate with other list providers via data APIs.

The REI/kit solution

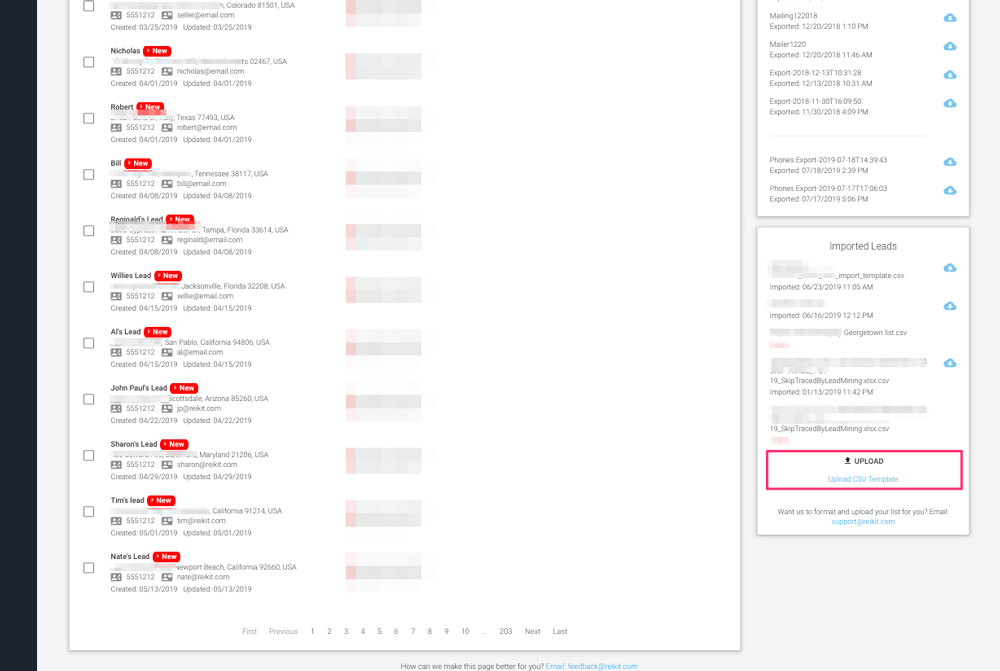

REI/kit falls in the Best house flipping software category.

We provide both our own highly motivated seller leads that are skip traced for phone numbers and in many cases email addresses, and we also allow you to upload your own lead lists from outside sources, with optional skip trace, to then manage those leads inside the software.

Use while Driving for Dollars (D4D)

Poor Quality Software

Does not allow you to capture or see information on a property while driving for dollars.

Better Quality Software

May allow you to perform mobile capture of information, but will use free sources of data for an incomplete picture of the property and owners.

Best Software

Allows you to capture lead information, get up to date premium data on the owner and property, and perform an deal analysis on a property while mobile.

The REI/kit solution

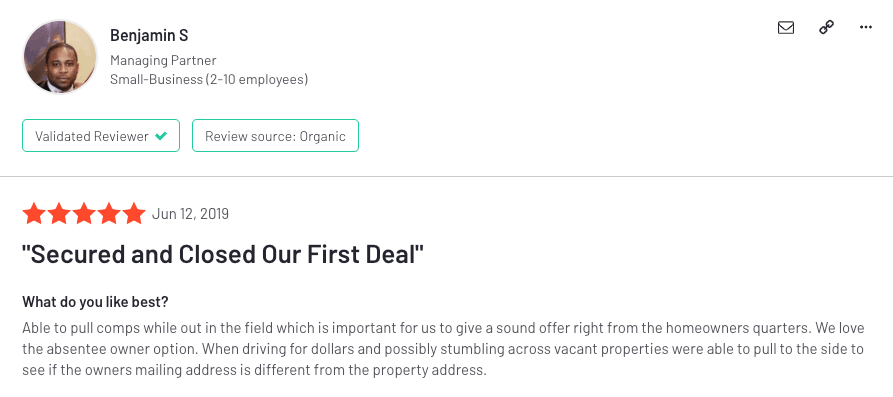

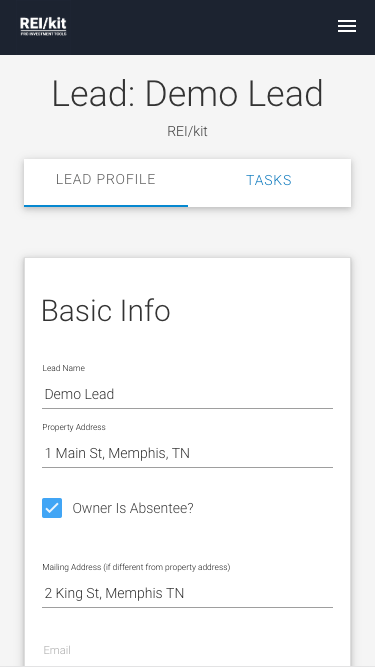

REI/kit is mobile friendly and allows you to not only capture lead information while on the go, but also run comps and complete an analysis right in front of the property.

Our data also shows whether it is an absentee owned property to let you know if the owner lives there before you knock on the door.

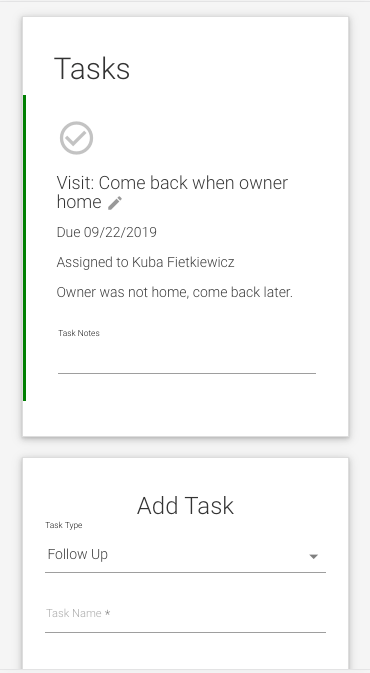

If the owner did not answer the door, you can even assign follow up tasks to your team members such as to return to the property or meet with the owner.

Rating House Flipping Software for Lead Generation

Poor Quality Software

Has no lead generation component at all. If you have no leads you have no house flipping business.

Better Quality Software

Has at least one or more way for you to generate leads. Inbound warm leads are better and the number one place that you need to be sending them with your marketing whether online or offline is to your website.

This is where REI/kit falls in as a value play where you get lead lists that are skip traced for phone and email, a website, and a way to import leads from other sources like ListSource, and a way to manage the data and conversion of your leads in the CRM.

Best Software

Will have multiple lead generation components including websites, direct mail, as well as email and text all automated.

I have personally not found all in one software that performs all of these tasks well, so you will likely need to run several pieces of software in tandem.

Step 2: Lead Management

Once you have a lead in your system, what should you do with it? Your software should have a lead management component to help you with the follow up necessary as your lead goes through your sales cycle to become a deal.

Are you keeping track of your lead data effectively? Can you capture a complete lead profile with over 100 data points?

Does your software allow you to maintain lead communications within the CRM visible across your entire team?

Can you schedule and assign lead follow up to your acquisition team members such as virtual assistants, bird dogs, or even realtors?

CRM for Lead Management

A CRM for lead management allows you to keep track of all of the information on a particular lead with every contact that you have with that lead as they move through your sales funnel.

Because in order to scale your house flipping business you will need to work with at least 5,000 leads, keeping all of their information organized in one place where your entire team can access it is critical to moving those leads from prospects to deals.

Poor Quality Software

Does not have a CRM for managing your inbound leads and no way to keep track of leads.

Better Quality Software

Might integrate an outside lead management solution such as Investorfuse into the lead funnel.

Best Software

Has a built in CRM and lead management functionality for inbound motivated seller leads, to help you capture over 100 data points on a lead, and keep all of the documents together with the lead as they move through your sales funnel.

The REI/kit solution

REI/kit house flipping software includes a fully functional CRM that allows you to capture over 100 data points on your leads.

Lead Task Management & Delegation

Lead task management is the ability for you to be able to delegate the actions necessary to process a lead at scale. It takes a team to scale a business and a critical component of that is the ability to have that team know exactly what they should be working on so that the leads never fall through the cracks.

Poor Quality Software

Does not have lead follow up task management.

Better Quality Software

Might integrate with third party software to have lead follow up task management.

Best Software

Has lead task management built in.

The REI/kit Solution

Lead task management is built into the REI/kit Real Estate CRM. You can assign automated tasks to your team members so that everyone on your team knows exactly what they should be working on.

Email Communication with a Lead

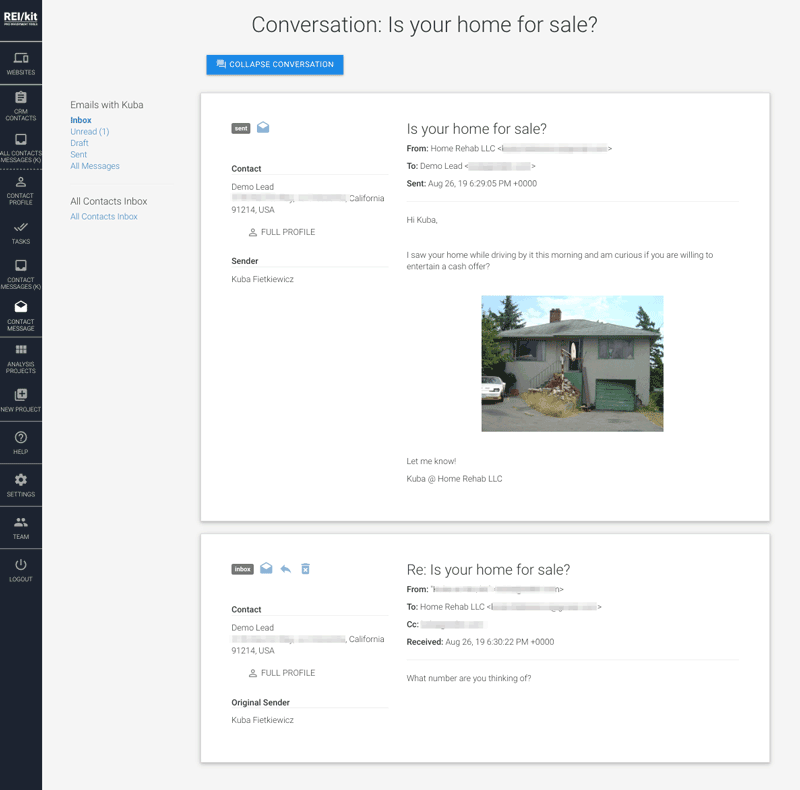

Once a lead ends up in your lead funnel, a large majority of your lead contacts will be via email, especially if they came through your real estate investor website.

If you want your entire team to have a full view of your communications with that lead, then the CRM needs to have the ability for your entire team to communicate with that lead and capture those communications.

Poor Quality Software

Does not allow you to communicate with your lead.

Better Quality Software

May integrate with other software that allows for communication with a lead.

Best Software

Has lead email communication built in so that the entire acquisition team is aware of all of the communications with the lead.

The REI/kit Solution

REI/kit includes full email capability with your leads from within the CRM, visible across your entire organization.

Lead CRM Integrated with Expert Deal Analysis

What separates a CRM that is part of the best house flipping software from a general purpose CRM is the tight integration of the CRM and the other components of the software.

Specifically the integration with the expert deal analysis tools necessary to determine whether the lead is worth working on in the first place.

Without that tight integration, you would spend far too much time working on leads that don’t make sense to pursue.

Poor Quality Software

Does not integrate a lead profile in the CRM with expert deal analysis tools.

Better Quality Software

May integrate with external tools for deal analysis.

Best Software

Has a complete picture of a lead with the ability to perform multiple analyses for different exit strategies based one expert analysis tools and data.

The REI/kit Solution

REI/kit includes the ability to create multiple expert analysis for each lead to understand the potential deal profitability using different exit strategies.

Step 3: Expert Deal Due Diligence – Defend Your Margins and Profitability

Measure twice, cut once.

Some software providers out there would like you to believe that analysis is easy and to analyze a deal all you need is a calculator or a spreadsheet. That’s probably because their software is incapable of anything other than surface level analysis so that is what they want you to believe is all that you need.

Unfortunately, if you don’t spend the time and effort to get this right, it doesn’t matter how well you manage a project, you’re going to come out losing money in the end, killing your business.

The inverse of this is not true. If you get your valuations and margins right, then you can screw up a whole lot of things, and still come out on top.

This is precisely why we have so many HomeVestors franchisees as clients who use our expert analysis software despite having access to their own software in-house.

This is also why I have customers who tell me in private things like this: “I use your software to prevent me from cutting another check for an $84,000 mistake in property value”.

That right there my friends, is why I get up in the morning.

To evaluate whether the real estate investment software that you are looking at just gives you a plain calculator, or an extensive suite of tools to prove to you that you should be doing the deal, you have to first understand the characteristics of what makes up the best real estate investment software.

1) The best house flipping software uses appraisal tools and techniques to get an accurate ARV: If you do only one thing right, this is it.

2) The choice of comps data sources affects ARV by thousands of dollars. Use an app dependent on free Zillow data, and you will be throwing darts instead of performing an actual value analysis.

3) Repair cost estimation: Nationwide constructions costs: Without data for nationwide construction costs, how can you truly know what the flip will cost?

Data is what makes you an intelligent investor, and if you’re not paying for data you get what you pay for.

Premium Property Data: Comps, Owner, and Mortgage Info

Poor Quality Software

Does not give you access to premium data and charges your for free incomplete source of data to make poorly informed decisions.

Better Quality Software

May allow you to import data from other sources into your analysis.

Best Software

Has access to premium sources of nationwide comps, owner, and mortgage data updated regularly.

The REI/kit Solution

With REI/kit you get access to premium regularly updated public record data that shows you accurate comps, who the owner of the property is and what they might owe on their loans.

Accurate Comps Data

There are really only 2 places to get property data: from public record, and from the local MLS. Public record data can be found by going directly to the public record databases, whether they are online or offline, or by using third party data providers that aggregate this data either in a limited area or nationwide. These are data providers such as PropertyRadar (limited area), ListSource, and even Zillow.

MLS data is only available to licensed real estate professionals under very strict rules of access reserved for the purchase and sale of real estate.

Poor Quality Software

The worst kind of software is one where they tell you that they get MLS data from Zillow, as such a thing does not exist. If they are lying to you about that, then they are likely lying to you about everything else.

The second absolute worst software uses Zillow data to give you comps for a valuation. What they don’t know and don’t tell you is that Zillow will not provide the same comps to these software companies via their API as they have on their own site.

Any software that uses the Zillow API to provide comps is worse in my opinion than software that does not provide you with any comps at all.

Other poor software will just use the automated valuation of one of these services.

The Zillow API is free and in this instance, you get less than you paid for.

Better Quality Software

Better software includes software that provides you suggestions of comps from full and complete paid sources of the public record.

Best Software

The best software allows to both use public record as well as MLS data in your analysis. Because of the difficulty in getting this data, this software is typically much more expensive. A good alternative is software that allows you to import free MLS data for your comps analysis.

The REI/kit Solution

REI/kit pulls a full set of premium public record data to ensure complete accuracy, not the junk provided by Zillow.

Read this product release from over two years ago when we switched away from Zillow as a source for our comps to understand just how much more accurate our comps are:

REI/kit Premium Data Records Update

Additionally, with REI/kit you can also add your own data from outside sources into your analysis, such as from the MLS.

Accurate After Repair Value (ARV)

When the time comes to sell your rehabbed property, it is an appraiser that will determine the value for the buyer’s lender. For that reason, it is important that the software you choose to evaluate a potential deal uses standard appraisal techniques to help you come up with an after repair value.

Poor Quality Software

Poor quality software will either take an automated valuation from a web site as gospel, or worse yet, take automated valuations from 3 different sources, average them out, and give you a number. This is problematic in a number of ways.

First, automated valuations, while always getting better due to ever improving machine-learning models, are still notoriously error prone and inaccurate.

Second, taking an average of 3 inaccurate numbers gives you an even more inaccurate number, essentially just giving you the average of 3 guesses. Even if one of the guesses was correct, the average will still point away from the correct number.

Any accuracy that you will get using this method is going to be by luck, which is not a great investment methodology.

Better Quality Software

Better software gives you comps that you can select from, using the appropriate criteria. The criteria that you should use to select comps include comps that are at least:

- Recent

- In the same neighborhood

- Within 10-20% of each other in terms of size

- Similar in terms of bedrooms, bathrooms, and other features

Best Software

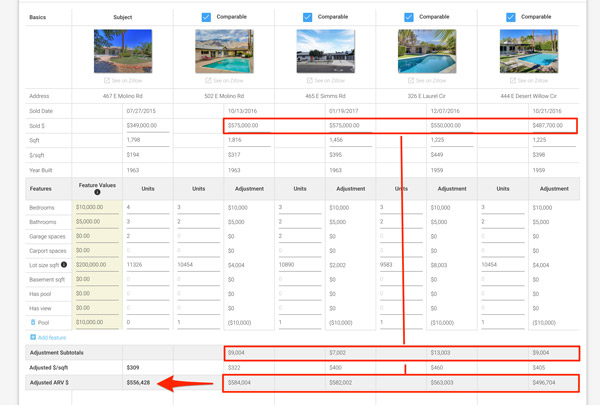

The best real estate flipping software goes one step further beyond just finding comps, and gives you the ability to perform a sales comparison analysis.

A sales comparison analysis is the technique that appraisers use to analyze comps. With this technique, not only do you select appropriate comps using the selection criteria above, but you also adjust for the market value of the major differences between your properties.

Most realtors won’t perform this step for you when they give you comps, yet this could mean a difference of thousands to hundreds of thousands of dollars in the final value of your property.

The REI/kit Solution

REI/kit is the only software on the market that gives you all of the facilities of the best fix and flip software including the ability to perform an in-depth sales comparison analysis using appraisal best practices.

Rating Software for Property Rehab Estimation

Can you estimate rehab scope of work based on published cost data?

Property rehab estimation tools are often found within house flipping software, with varying abilities. The software you choose should allow you to estimate repair costs in a variety of ways, get construction costs from a reliable source, and give you enough costs to select from to get as precise an estimate as possible.

Poor property rehab software

Inadequate real estate rehab software, from a rehab construction costs standpoint, is one where they have not included any of the features mentioned above.

Many rehab estimation spreadsheets are just that, static spreadsheets with no data in them, only cells for you to enter your own costs that you found elsewhere. This is usually the case in what are called rehab estimation calculators.

Better property rehab software

The next step up from that is a rehab estimation spreadsheet with pre-filled construction costs. Those are usually static costs that are not updated once you download the spreadsheet, unless you purchase the spreadsheet again. If that spreadsheet only has costs for where that spreadsheet provider is located, or if the costs are not indexed – that is, costs for precisely where the property is located – the results will not be accurate.

Best property rehab software

The best house rehab software will allow you to enter your rehab costs in a variety of ways (including the ways mentioned above), at different levels of granularity.

The REI/kit Solution

Within REI/kit you can enter rehab costs in your analysis using 3 different methods:

Rough number

If you are performing an initial analysis to see if the property is even worth visiting, you might have a number based on dollars per square foot. The software should let you enter one single number for rehab costs just to see if a deal has enough spread.

Broken down by system

When you first visit a property, you will generally perform a rough estimate of the major systems using a punch list. You would want to do this before you spend any serious time performing a detailed construction cost estimate to get a rough idea of the deal economics.

Here’s the rehab estimation punch list that we print out and fill in while performing an initial walkthrough of a potential house flip:

After the walkthrough it’s easy to then use the notes from your walkthrough to estimate your potential costs in REI/kit.

Itemized construction cost estimate using nationwide costs data

After you have entered your initial estimate and the deal appears to still make sense, at this point the software should also allow you to create an itemized rehab cost estimate using a nationwide list of labor and material costs.

Rating Software for Exit Strategy Analysis

What is the best real estate investment software for exit strategy analysis? What works for you now might not work for all investments, or future investments. The best software provides flexibility in determining your exit strategies, allowing you to model what a real estate investment property would return on your investment as a fix and flip, buy and hold, BRRRR, or wholesale, all in one interface.

Poor real estate investment software

Will focus on only one exit strategy.

Better real estate investment software

Will support multiple exit strategies, but the analysis will be limited.

Best real estate investment software

Will be flexible to support any number of strategies by supporting the itemized analysis of income, expenses, purchase, sale, and repair costs, financing and JVs.

The REI/kit Solution

REI/kit gives you the ability to model a wide variety of exit strategies popular with house flipping, wholesaling, and rental real estate investment including house hacking and BRRRR.

In addition to exit strategy analysis, you also want the ability to model multiple financial scenarios.

Rating Real Estate Analysis Software for Flexibility in Modeling Scenarios

When real estate investors do an analysis on a property, much of it is simply adjusting the numbers to find the combination with the best financial outcome. The best software will have the flexibility to model multiple “what-if” scenarios, and break those numbers down into an itemized list, or override them with one single number.

For example, in a multi-family rental analysis scenario, the best software would let you to itemize income and expenses or override those inputs.

In the case of income, it would allow you to enter a flat rental amount for the entire property, or override that with an amount for each individual unit.

Similarly, for rehab improvement costs, it allows you to itemize down to the material level, or override costs with a single number. This enables you to see how the overall financial picture changes for each scenario.

Poor real estate analysis software

Probably only lets you enter a number as an input to your analysis.

Better real estate analysis software

Allows you to itemize your analysis inputs.

Best real estate analysis software

Allows you to either itemize your inputs, or override them with a general number.

The REI/kit Solution

REI/kit allows you to either itemize your inputs, or override them with a general number.

Modeling Creative Real Estate Funding Scenarios

The house flipping software you choose should allow you to model complex financial scenarios, not just basics such as down payment, rate, and term. These complex scenarios may include multiple loans, at different rates and holding periods, with a potential of profit sharing on the back end.

Poor Quality Software

Lets you add a number for financing.

Better Quality Software

Might let you add some loan characteristics such as rate and down payment.

Best Software

Your software should allow you to determine the best financing method for a property, by modeling different scenarios such as the following:

Loan 1: 65% purchase price hard money purchase loan at 10% and 2 points, with $500 fees

Loan 2: 100% hard money construction costs at 10% and 2 points and no fees

Loan 3: $100,000 private money at 7% and 25% profit split on the back end

Loan 4: 75% conventional refinance after 6-month seasoning period

The REI/kit Solution

REI/kit allows you to capture an unlimited number of loans to show your entire loan exposure.

Step 4: Deal Marketing – Get more of your deals financed and sold

Your software should be able to produce underwritable reports based on the extensive analysis that you performed to defend your own reasoning, and include that data as part of a professional deal pitch, whether to lenders for funding, or to other investors for resale.

The questions you should be asking when evaluating the deal marketing components of your house flipping software are as follows:

Can you create reports to market your deals for resale or funding?

Does your deal marketing tell the right story?

Does it help you pitch your private money partner that their money is safe in your hands?

Does it show your investors how good of a deal you have in front of them?

Each investment exit strategy has a set of metrics that the best software should be able to calculate, and also provide detailed reports to share with those lenders, partners, and buyers.

For house flipping, the most important metrics are profit, how much money is required out of pocket, what the return on investment (ROI) is, what the rate of return (ROR) is, and in some scenarios, the JV split.

For rental scenarios, the most important metrics are not only cash flow and cash on cash return (COC), but also the gross rent multiplier (GRM), the operating expense ratio, and the internal rate of return (IRR).

And for lenders, the more data that you have to support your valuation, and your rehab costs, the easier it is for them to fund the deal.

Professional Deal Pitch Reports

Poor real estate investing software

Only has one limited report for one specific exit strategy with limited information inside.

Better real estate investing software

May have multiple reports for different exit strategies and should contain the most important metrics for those strategies.

Best real estate investing software

Should have multiple reports, with metrics specific to each strategy. Additionally, the reports should be configurable so that you control the data that is shared.

The REI/kit Solution

REI/kit deal marketing reports give you the ability to tell the right story to the right audience. You can show and hide each section of each deal pitch report. Each section is designed to tell the complete 360 degree story of the viability of the deal.

Deal Marketing Integrated With Your Website

Can you integrate your deal marketing reports on your website and build your buyers list?

Can you show your previous projects on your website to your lenders, and reduce your risk rate based on your experience?

Poor house flipping software

Cannot show your reports on a website.

Better house flipping software

May be able to show your reports on an external website.

Best Software

Integrates reports with your website so as to display your deal inventory that you can use for finding funding for your flips or cash buyers for your wholesale deals.

The REI/kit Solution

Your REI/kit real estate investor website is tightly integrated with your deal pitch reports, allowing you to show your deal inventory to your lenders and cash buyers with the click of a single toggle.

You Get What You Pay For

(as long as you avoid the hype and use the evaluation framework and figure out what you need)

Building good quality software with good data is very expensive, so when you see free, or low cost software, there’s very likely a reason for this: their claims are probably exaggerated, and it has neither good data, nor the features that you need to help you honestly build your business.

So when you see free, or low cost software that claims to have the same features and benefits as software 10X the price, the simplest explanation is that it is only actually offering you 1/10th of the features, or that there are hidden fees.

Here are some expectations of software at different price levels:

$1-10/mo

You will typically just get a calculator, or any of the limited software qualities. When you pay very low amounts for software, it is being used to make it easy for you to be constantly upsold by the company for a much more expensive product or course.

TIP: This is not to be confused with the standard practice of free trials where you enter your credit card up front. Free trials are a great way to help you evaluate well-priced software where there’s no expectation for upsell to an expensive course.

You should generally avoid software that costs $1-$10.

$10-$50/mo

You might get a small amount of the features under the better software category.

This software is good for beginners who are not sure yet if real estate investing is for them.

This usually falls into the toy or hobby software category and will not be adequate for you if you are looking to scale your business in a meaningful way.

$50-$99/mo

The software is likely very good in respect to one or more features, and sometimes an up-and- coming company that is trying to get a foothold in the market. This software is often underpriced, and there is opportunity for early subscriber customers to get much more value in return for their money.

This software is good for beginner to intermediate investors who have committed to building their business, but may not have all of their systems in place, or enough money to spend on expensive software.

$99+/mo

The software has solved a particular pain point very well, or is likely an established leader in their market, so they can command a premium.

Summary

In this post, I defined several key dimensions that the best house flipping software should have, to arm you with enough information to help you choose software with features and pricing that works for you with the ultimate goal of scaling your house flipping business. Sometimes it’s not as simple as relying on claims, and depending on your budget, might require compromise between price and features.

In the end and in most cases, you really do get what you pay for, so if you have an extremely limited budget, in my opinion you will be better off by not buying any software at all so as to avoid exaggerated claims, and constant upsells.

REIkit.com was created to overcome the poor quality of the real estate investment software on the market today, and a free trial is available for you to test out all of the features and see if it’s right for you.