If you care about accurate comps, or cash buyers, then you might want to read this all the way through.

For the last 2 years since switching away from the inadequate free Zillow data in our paid app *, we have worked tirelessly to bring you the most accurate comps that meet appraisal best practices, and the tools to perform an appraisal-like sales comparison analysis.

(* we do still use the free Zillow data on our free comps tools for demo purposes)

For those in the know, our tools and premium data are by far better than most tools out there at any price.

But being better than the other guys is not enough for me…I want REI/kit to be better than REI/kit.

So although you may not notice, we are constantly making small incremental changes and improvements to our data sources and algorithms to improve the results that come back for you, so that you can be the most effective real estate investor that you can be.

However once in a while, we can find that next level improvement that takes us from “better than the other guys” to “best in the business”.

How?

One of the most difficult parts of comping a property with professional results is having the right data to be able to rationalize whether you should include a particular comp in your property value analysis.

What rationalizations should you make?

When determining the market value of a property, the absolute best comps are those where the sales are arms-length transactions using conventional mortgages, without any undue influence on motivation such as an impending foreclosure.

Much of this data is scattered among various sources, and for a lot of it, the only way to get it is to pay for it. We certainly do.

Where previously much of this information has only been available to those with access to expensive tools, this new data is now available to our Professional and Business plan customers**.

(** This data falls within each plan’s analysis projects usage limits which you can see on our pricing page. See below for all eligible plans.)

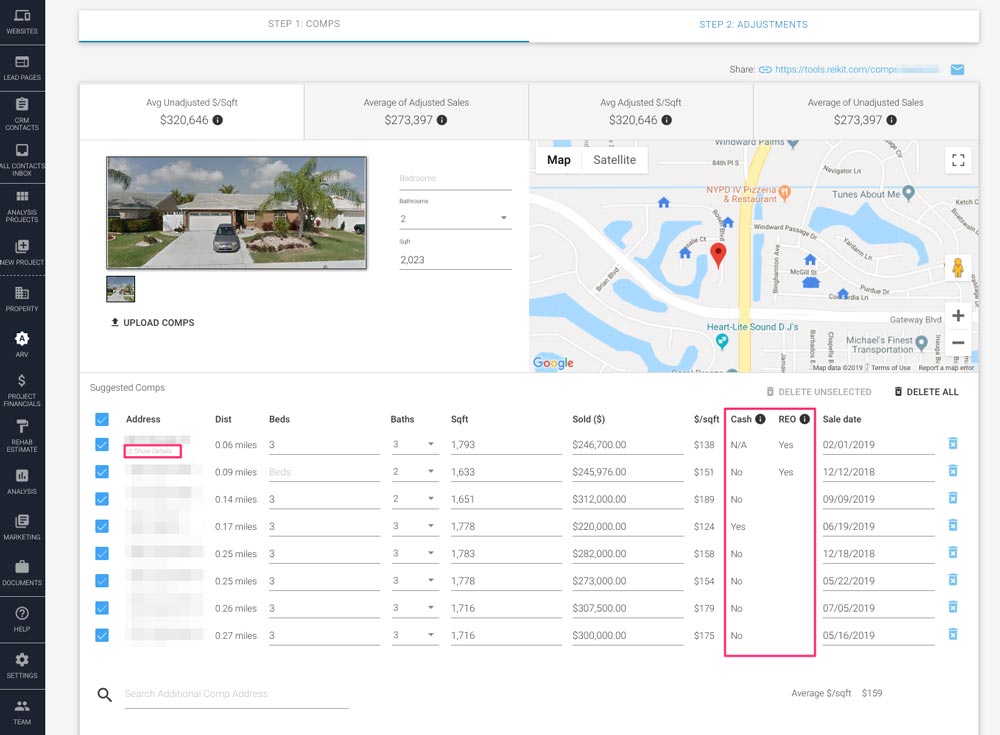

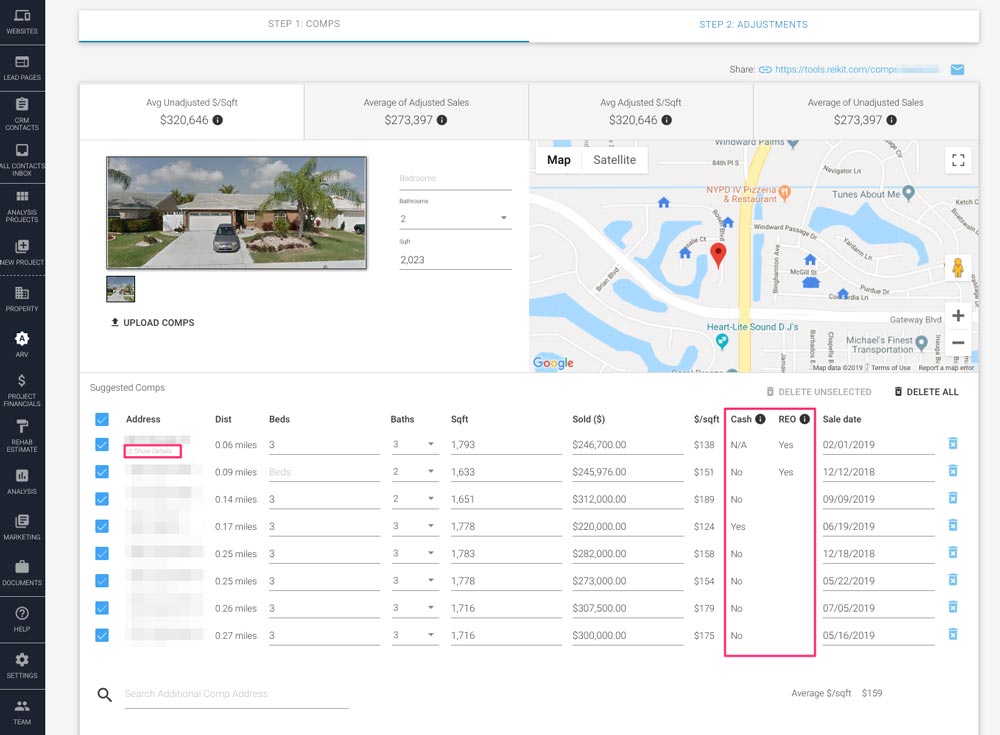

What NEW data is available?

There are 6 new data points available in the REI/kit comps interface:

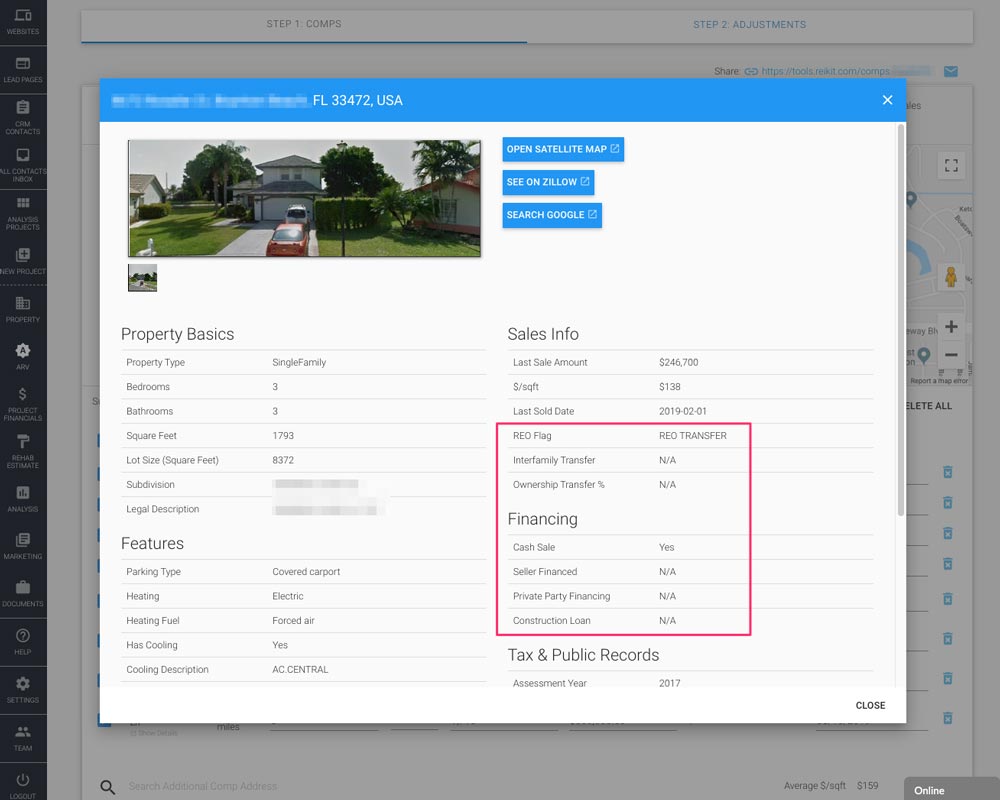

REO Indicator

This data point will tell you whether the sale was related to a foreclosure proceeding and it speaks to the motivation of the seller of that comp. Comps that have this indicator should not be used in determining the market value of your subject property as there was undue influence on the seller to perform that transaction.

Interfamily Transfer

This data point will tell you whether this was an arms-length transaction. A property transferred between related parties is not a good indicator of market value and should not be used in your ARV analysis.

Cash Sale Indicator

This data point will tell you if the property was purchased with cash, or financed. A cash sale is a good indicator that the property was purchased by an investor for the purpose of flipping it.

Seller Financing Indicator

This data point will tell you whether the seller carried the loan. You should probably not use this comp in determining ARV as seller financed properties often sell for above market value.

Private Party Financing Indicator

This data point will tell you if the note is carried by a private lender.

Construction Loan Indicator

This data point will tell you if a construction loan was recorded as part of the sale. This may indicate the property to be new construction for example.

Knowledge is power, and all of these data points combined give you so much more power at your fingertips than you can get anywhere else.

But that is not all.

New detailed comp interface

To display all of this extended comps detail, we have built a new interface giving you the complete set of data that we have on that comp, so that you can much more easily see whether that comp should be included in your analysis.

In addition, in that interface we have added quick links to additional websites including the Google maps satellite view so that you can perform additional recon on the property and the neighborhood, as well as a Zillow link if found, and a quick link to search on Google.

With this new interface and data your future comps analysis will absolutely be next level, more powerful and efficient than ever before.

Good luck with doing this with any of the hundreds of so-called other house flipping software that charge you for free and incomplete Zillow data.

Incredible uses for this NEW comps data

Higher ARVs due to a true market value analysis

If you want to be sure that your comps reflect the true market value of your property, then you would exclude the comps that have been purchased with cash or that have the REO indicator.

When doing so, because properties sold with conventional financing typically sell for more money, your analysis will most likely result in a higher justified ARV for your flip or wholesale deals.

See if your offer is competitive with pre-rehab market values

Say that you have estimated your offer price given a full analysis in the house flipping software that accounted for all of your purchase, sale, and holding costs, rehab costs and your desired profit amount.

Given all of that information, do you know if the current market for pre-rehab properties will support your offer?

Now, you can choose only cash sale comps to see what the investor market is paying for similar pre-rehab properties, giving you complete clarity to see if your offer is competitive.

Conversely, you can stop leaving money on the table if your calculated offer is higher than what other investors are paying for properties in similar levels of distress, and you can adjust your offer accordingly.

Find potential cash buyers that actually purchase properties

Do you have a list of “cash buyers” that never seem to buy anything?

Well that cash buyer that actually purchased the property next door is a perfect target for your next wholesale deal.

To find the buyer’s name and mailing address, you can again use REI/kit by just performing a new analysis project on the comp itself.

Then you can send that cash buyer a letter (outside of REI/kit) pointing them to your REI/kit real estate investor website wholesale deal inventory page.

(Here’s what that page looks like on our example website: Wholesale deal inventory page example)

Pricing

Existing customers

As we generally don’t increase pricing for existing customers, if you are on one of the plans that has access to this new data, then your pricing will not be going up.

New customers

Although pricing is not going up yet for new customers, it will be going up within a couple months due to the tremendous amount of value that we have already added since the last pricing update (Teams, CRM Email), and will be adding (Email Campaigns) before the end of this year.

So if you would like access to this data at current pricing, then you should lock that pricing in now, before it does go up in the very near future.

Check out our current house flipping software pricing.

Plan availability

Unfortunately due to the cost of this data to us, it can only be offered on select subscription plans.

Plans with access to this data

Current: Professional, Business

Legacy: November 30/2018, Lifetime

Plans not eligible for this data

Current: Starter

Legacy: Pre-Nov 2018

If you have any questions about this update please do not hesitate to contact support via the chat box or via the support email, or just email me directly.