Despite carefully following the most commonly used rules of thumb in real estate investment, new investors eager to get their first deal under contract, nearly always find their offers immediately rejected.

They frequently experience the following scenario play out:

I follow all of the rules of thumb, make sure I’m conservative with my numbers, and end up with an offer that’s way below listing price….and this is the 10th one that has been rejected.

or

My MAO says that using the 70% rule, I should offer X which is less than half the listing price, and my realtor won’t even submit the offer.

So what do these frustrated investors end up doing?

Repeatedly faced with this result, these investors end up doing one of two things:

The Hamster Wheel

Keep trying by applying the same analysis math that they were taught on investor sites and forums, thinking that if they just submit enough offers, they will eventually get a win. Hopefully they won’t burn through too many realtors in the process.

The Leap of Faith

Worse, they end up fudging the numbers just to get a property under contract, with the details of how to profit left to figure out later.

Not surprisingly, the offers on those deals are so far below the market expectations that either they are too low to ever be accepted as in the first case, or the offers are such that the deals just won’t pencil as in the second case.

Sound familiar?

So what’s the problem?

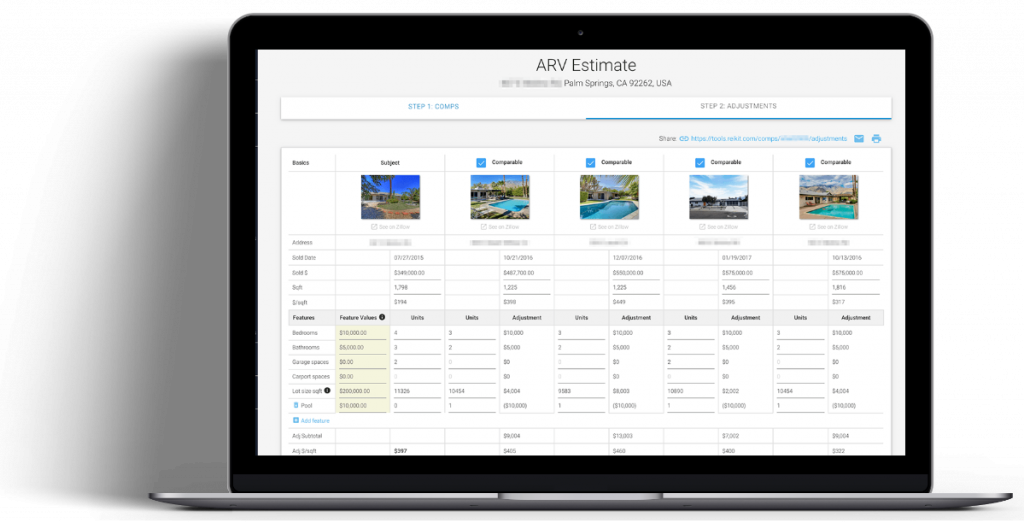

What these new investors fail to see is that they are trying to apply investor math, to what they know about, and what they have always used: consumer systems.

New investors fail to see is that they are trying to apply investor math to incompatible consumer systems Click To TweetWhat?

Let me explain.

Consumer systems

Consumer systems are designed to allow people the ability to trade money for time. This is how our consumer economy works. They are low friction to be as easy to purchase as possible; mass appeal and easily accessible; and designed to be at the highest possible cost: market cost.

What are some examples of these readily available systems used by new investors?

Deal flow

MLS, on-market properties, already passed over by investors, in competition not only with other investors, but with every single home buyer.

Construction

Retail-focused General Contractors found on Angie’s List or the home improvement magazine, priced at maximum consumer markups.

Sales

Full service brokerage, with market-priced commission.

Investor Systems

Investor systems are those systems, created and used by investors to allow them to extract the most amount of profit. They are only available to those willing to work for them, typically require some level of up front investment.

For example:

Deal flow

Relationships with real estate wholesalers who find distressed properties, and realtors with pocket listings who know that you’re going to be able to close quickly. You can also invest in marketing for off-market distressed properties using direct mail, or online advertising.

Construction

Relationships with General Contractors, in-house GC, bulk discounts.

Sales

Relationship based negotiated cost listing, sales in-house.

So what should new real estate investors do instead?

In order to get their math to work, and for their deals to pencil, new investors should spend more of their time investing in trying to get access to as many of these investor systems as possible, as soon as possible.

How?

There is a common theme that binds all of the listed investor’s systems: Relationships.

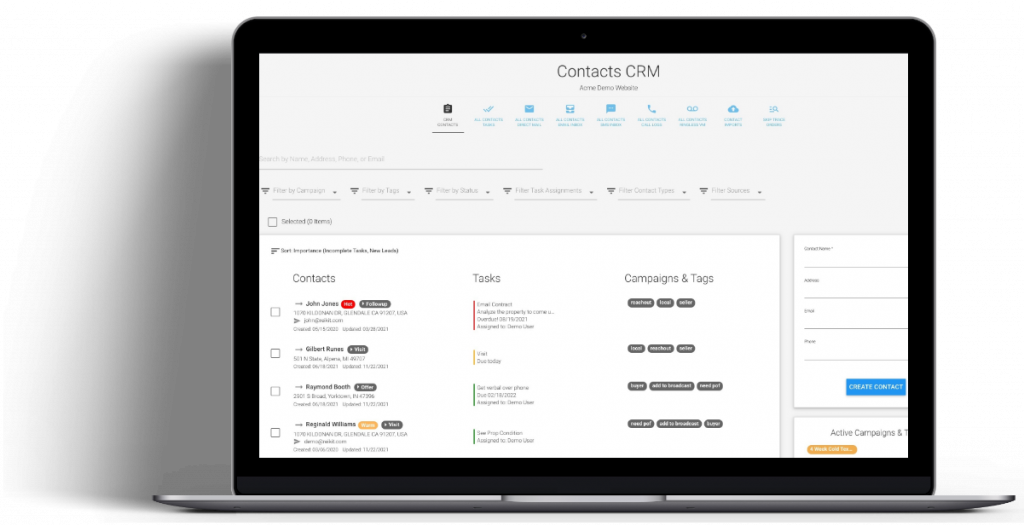

In order to get your deals to pencil, you need to get out from behind the computer and build relationships.

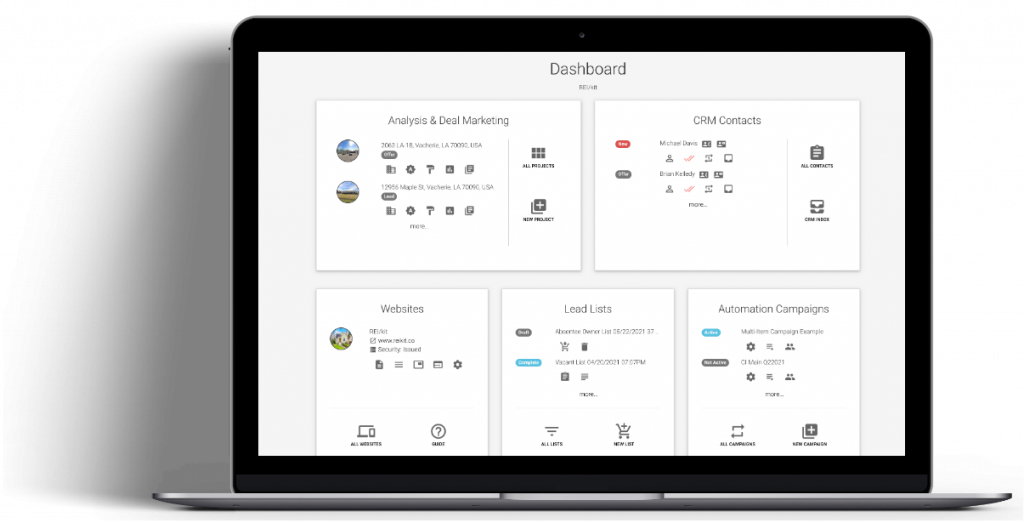

In order to get your deals to pencil, you need to get out from behind the computer and build relationships. Click To TweetSeems like odd advice from a vendor of online software for real estate investors, but the bottom line is that I want you to be successful; otherwise you don’t need my real estate investment software.

Where do I start to build these relationships?

Deal flow

Get off your computer and connect with other investors, real estate wholesalers, lenders and agents in the areas you invest in by going to real estate investment meetups in your area.

Learn about driving for dollars and knocking on doors. Not only is it the best way to learn a market, it is still one of the most cost-effective ways to find off-market leads.

Driving for dollars is still one of the most cost-effective ways to find off-market leads. Click To TweetIf you simply cannot get away from your computer, you can network with real estate wholesalers in your area by searching for groups on social media. Facebook groups are not only great for networking with other real estate investors in every city, but also for the wealth of educational opportunities from interacting with others that are at different stages of their careers.

One of the largest, most active groups with over 40,000 members is Alex Joungblood’s Wholesaling Houses Full Time group:

https://www.facebook.com/groups/WholesalingFT/

Construction

The same resources listed above will also help you find competent investor-friendly contractors.

One of my favorite low-cost ways to find investor-friendly contractors is to go to existing rehabs in the neighborhood and approach the contractors directly. They are always looking for the next job, and very often they are so proud of their work, that they will want to show it off.

Sales

Apart from general networking and in-depth blogs written by thousands of investors, you can search for and connect with investor-friendly realtors on Biggerpockets.com.

If you’re looking to buy or sell an investment property in Southern California, you can feel free to get in touch with me to discuss your strategies and if I can’t help you, I’ll be more than happy to refer you to someone who can.

Summary

Accessing investor systems is not hard, but it does require you to stop trying to take the easy way out by using the same old systems that you have been using before you started investing in real estate.

Success in real estate investment requires that you to work harder than everyone else to build relationships and get access to deals that would not normally be possible, with access to off-market deals, and exceptional contractors and realtors willing to cut you a break with a certain promise of future work. Then and only then, will your math start to work, and your offers start getting accepted.