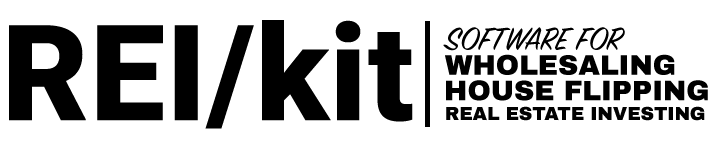

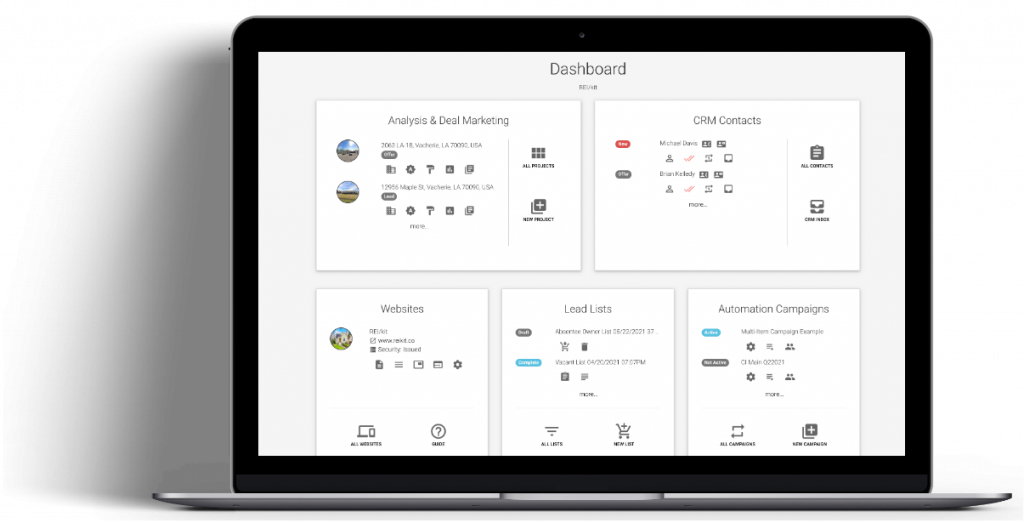

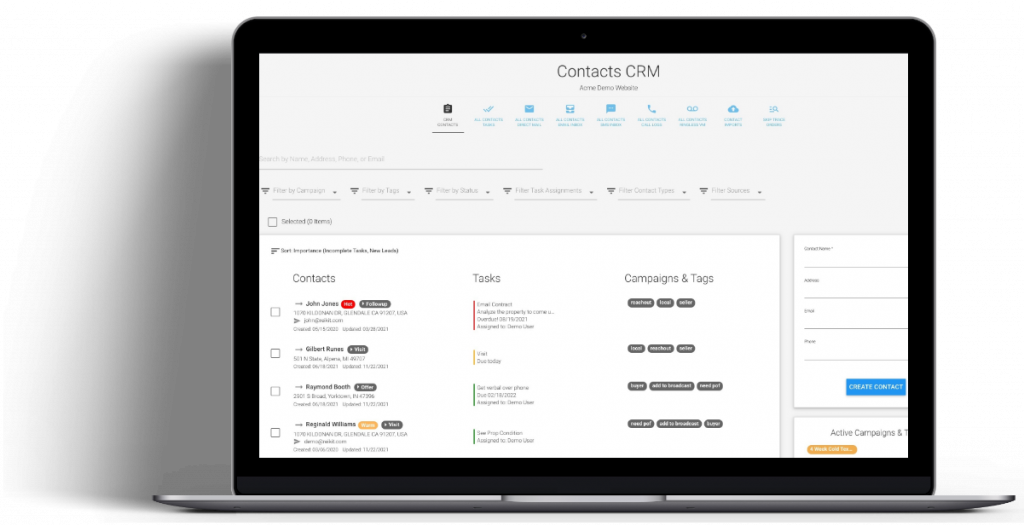

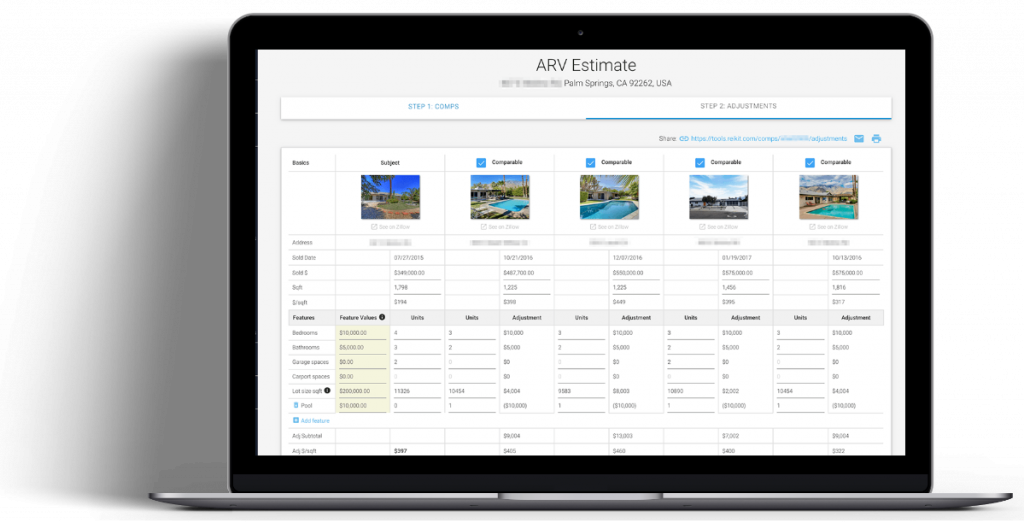

In this video and post we are going to analyze a property that was advertised on BiggerPockets as a potential BRRRR real estate investment strategy candidate. In order to perform the analysis, we will be going over: An Overview: What is BRRRR? The Potential Deal What is the 2% Rule? Gathering the Due Diligence Data Verify the After Repair Value (ARV) Identify the Rehab Costs Enter the Purchase, Sale, and Holding Costs Purchase Costs Sale Costs Operational Expenses (OpEx) Modeling BRRRR Financing: Buy, Rehab, Refinance Hard Money Purchase Loan for Purchase & Rehab FHA Conventional Refinance Rental Property Income Capital Expenditures (Reserves) Itemizing CapEx How Does CapEx Affect Your… Read More

Continue Reading