The purpose of this post is to help you understand the deal analysis math behind the most important house flipping formulas, to ensure that your rehab project is going to be profitable.

I’ll talk about the math behind profit, and ROI, how to determine your maximum offer. Additionally, I’ll include some guidance and helpful rules of thumb.

These are a few of the numbers that will help you determine if your deal is going to be worth pursuing:

70 Percent Rule

So let’s get started:

Project Costs

We will need the list of project costs to support our profit formula. Summarizing the costs from the post, Fix & Flip Project Costs: Purchase, Sale, & Holding, the following are all of the costs involved in the project, including purchase, holding, rehab, and sale costs. Adding all of those numbers together, gets us the total project costs:

Project Costs = Purchase Price + Purchase Costs + Holding Costs + Rehab Costs (with Contingency) + Sale Costs

Profit

Profit should be easy to wrap your head around. It’s the money left over after subtracting all of your costs from the sale of the property. Remember that the sale price of your property we determined on day 1 by coming up with an After Repair Value. For profit, we have the profit formula:

Profit = ARV – Project Costs

On my own deals, on the low end, I aim for a minimum $15,000-$20,000 profit. Any less and you are either working for minimum wage at a high risk job, or in the worst case, you don’t have enough buffer to counter losses from unexpected issues that come up during the rehab.

Return On Investment (ROI)

ROI, or Return on Investment, is a ratio of profit to the money that it took to execute the project. The formula to determine ROI is thus:

ROI = Profit / Project Costs

Similarly to Profit, on my own projects I aim for a minimum 15-20% ROI. These rules of thumb ensure that you don’t rationalize yourself into a deal that is either too risky, or where the margins aren’t adequate.

Rate of Return (ROR)

The Rate of Return, is the ROI over a particular period of time. This number is useful to help you understand the effect of the deal on your overall business for that period of time. I typically measure it in terms of a year, and so the rate of return formula is:

ROR = ROI/Holding Days * 365

Think of ROR as a measure of a deal’s desirability. Whereas ROI helps you determine margins, the ROR helps you evaluate which deal to go after between similar deals.

For example say you have the following 2 oversimplified deals:

Deal 1: 90 day project, 20% ROI

Deal 2: 180 day project, 30% ROI

The ROR on the first deal is 81% (20/90*365), and the ROR on the second deal is 61% (30/180*365). That means that even though the ROI for the first deal is significantly lower than the second, your business will grow by an extra 20% for the year, if you choose to go after deals like the first one.

The minimum ROR that we look for in our flip deals is 30%.

Maximum Allowable Offer (MAO)

Whenever looking at a property to purchase, in order to make your numbers work, the Maximum Allowable Offer is the offer that you should aim to never exceed. Of course, you should aim to offer and purchase the property for even less than MAO, as it represents the worst case/most that you should offer to make the deal work.

To get the maximum allowable offer, you can use either of 2 methods: ROI, or the 70 Percent rule.

Using ROI

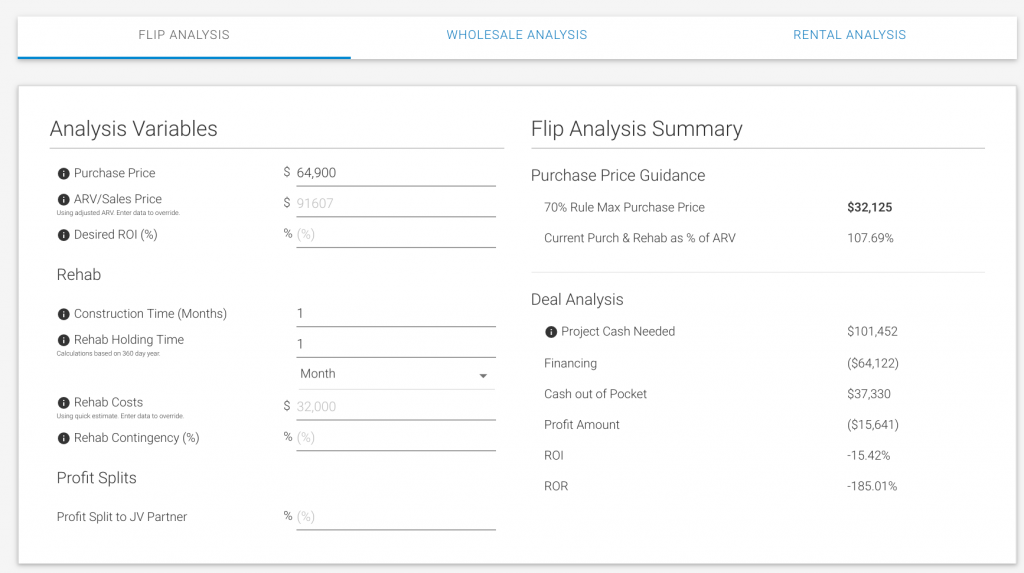

The first method is to use the ROI that you are trying to target. This is a complicated formula that requires you to factor variable costs as they change over time vs fixed costs. Using ROI allows you to really focus in on exactly how much to offer and meet your investment needs. We have built this into the REI/kit real estate investing calculator so you don’t have to worry about the math, and all you have to enter is your target ROI (15-20% on our deals.)

70 Percent Rule

This rule, often used by novice investors, is a rough approximation of deal viability that doesn’t require ROI math. In many cases the results of this rule fall within the 15%-20% ROI range which is why it works as a good initial framework for deal evaluation. One criticism of the rule is that because it’s not based on ROI it is not as powerful in helping you really understand the deal, and doesn’t give you the ability to measure deals against each other. Nevertheless, it is still a decent guideline to help you understand if you are paying too much.

The formula for the Maximum Allowable Offer using the Percent rule is quite simple, which is why it’s so popular:

MAO = (ARV * 70%) – Rehab Costs

For in-depth explanation of the rule and formula, including example, check out this post on the 70 Percent Rule.

The analysis tab in the REI/kit real estate investment app gives you really easy offer guidance in both ROI and 70% rule terms.

Days on Market and Absorption Rate

Novice investors often forget these two important numbers in their deal risk analysis, and yet the numbers can have a huge impact on deal viability and profitability. You can use these numbers to give you a clue about your holding time risk.

Days on Market

The Days On Market (DOM) number for a particular comparable property, lets you know how many days it took to sell the property. This information is useful in a couple ways.

From a risk mitigation standpoint, you should look at the average DOM of your comps to understand how long you should expect to hold the property once you list it. This is extremely important to know if you are using Hard Money, have large HOA payments, or if are in high tax areas like Chicago, as it will factor into your entire project holding period.

One example of extremely high days on market are seasonal vacation rental or second home areas, such as Palm Springs, where DOM can be up to a year.

Using an average of days on market based on your comps you can also get a pretty good idea of how you will need to price the property to ensure a quick sale, which could factor into how much you should purchase the property for in the first place.

Days on market information is available on the MLS as well as Redfin.

Absorption Rate

This advanced number related to DOM helps you understand the demand for homes in an area, by showing the rate that inventory gets removed (or absorbed) over time as new inventory gets added. This rate is best applied in the context of your potential deal property characteristics and pricing. You would like to know the absorption rate of, or demand for properties that are similar in features and similar in pricing to your deal.

The formula for absorption rate is:

AR (in Days) = Active Listings * Time Period / Sold Listings in Time Period

Where an absorption rate of

0-150 days indicates a sellers market

150-180 days indicates a balanced market

180 days indicates a buyer’s market

The other useful analysis you can glean from using absorption rates is in looking at whether they are increasing or decreasing over time. This can help you understand whether you will likely be able to benefit from appreciation during your holding period, or whether your projected ARV is too high to ensure a quick sale in a cool market.

You will need to get this sale data from the MLS.

Summary

The most important things to consider when evaluating whether a house flipping deal is viable include:

- Making sure that you calculate an accurate after repair value using good comps and appraisal techniques

- Creating realistic rehab cost estimates

- Accounting for all of your project, purchase, sale, holding, and financing costs

- Accounting for all of the risk of the project such as knowledge, and time

- Baking in enough margins and return on investment

- And paying the right price for the property based on all of the above

You can certainly do this with spreadsheets, but this is exactly what REIkit.com was built for.