When performing due diligence on a fix and flip property, it’s important to know whether to pass on the property, or proceed to inspect the property.

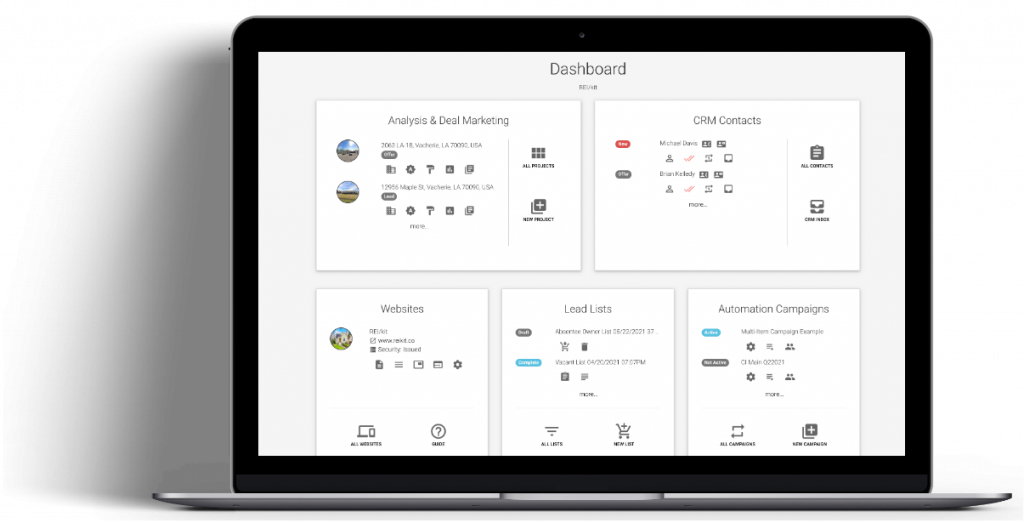

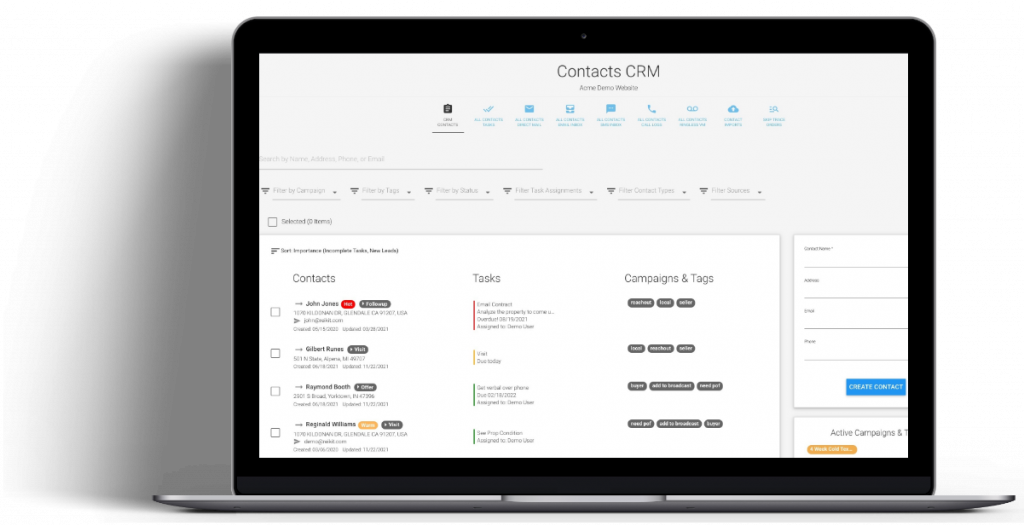

This house flipping initial due diligence checklist is for that first analysis when you find the property online. It is meant to be performed based on pictures and the information that you gathered online such as using our house flipping analysis software to help you determine whether or not you should visit the property.

Here are the steps you should take:

Determine level of flip rehab (light, medium, heavy)

Based on the pictures, estimate the amount of work that needs to be done, and determine how difficult it be to repair the property on a scale of light, medium, or heavy.

Determine holding time

Get a ball-park estimate of holding time by taking into account the level of property rehab, as well as how quickly properties are selling in that neighborhood. For example, a light property rehab might only take 1 month to complete, whereas a gut rehab may take 6 or more months.

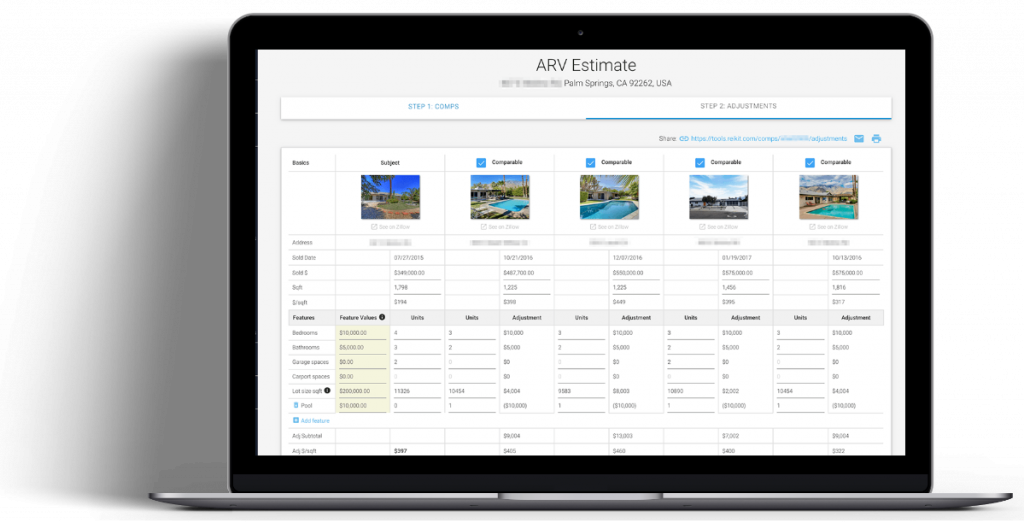

Find rehabbed comps with target finishings

Find real estate comparables that have been rehabbed or remodeled with the same level of finishes that you expect your property to sell for after repair.

Adjust comps for feature values

Identify the major parts of a property that are different between the subject and the comparables, such as bedrooms, bathrooms, garages, and pools. Give each feature a dollar amount, and adjust the comps for those features to calculate an accurate property After Repair Value.

Add purchase costs based on your market

Calculate potential costs to purchase the property, depending on your area.

- Wholesale Fee

- Broker Fee

- Commissions

- Inspections

- Survey

- Appraisal

- Title Search

- Owner’s Title Insurance

- Lender’s Title Insurance

- Attorney

- Escrow

Add sale costs appropriate for marketing effort of property (low, medium, high)

Calculate potential real estate sale costs for when you sell the property.

- Commissions

- Broker Fee

- Staging

- Property Photography

As well as these:

- Appraisal

- Buyer Closing Costs

- Home Warranty

- Termite Inspections

- Termite Tenting

- Title Insurance

- Transfer Taxes

- HOA Transfer fee

Add holding costs

Calculate potential house flipping holding costs to hold the property throughout the purchase, rehab and eventual sale.

- Alarm

- Insurance

- Utilities

- Taxes

- HOA Fees

Add financing costs

Calculate how much it will cost to borrow hard money or private money.

- Interest

- Points on origination

- Fees

Use general costs per square foot to estimate rehab costs

Calculate the general rehab construction costs of the property, based on the level of property rehab: light, medium, or heavy. For example, for a light rehab, you might calculate rehab costs per square foot at $20/sqft, whereas for a gut rehab, it might cost $100/sqft.

Set desired profit percentage to calculate target offer price

Whether you have a profit percentage in mind or are using a rule of thumb such as the seventy percent rule, calculate your target offer price.

Determine if gap between current asking price and target offer price is negotiable

If there is no room to negotiate, such as when the gap is too large and the seller’s motivation is too little, move onto next property. If otherwise, it’s time to review the condition of the property with a visit and the Flip Property Condition Review Checklist.

Download Free House Flipping Initial Due Diligence Checklist PDF

Download Free House Flipping Initial Due Diligence Checklist Excel

Final Due Diligence

Ready to move on to the final due diligence process?