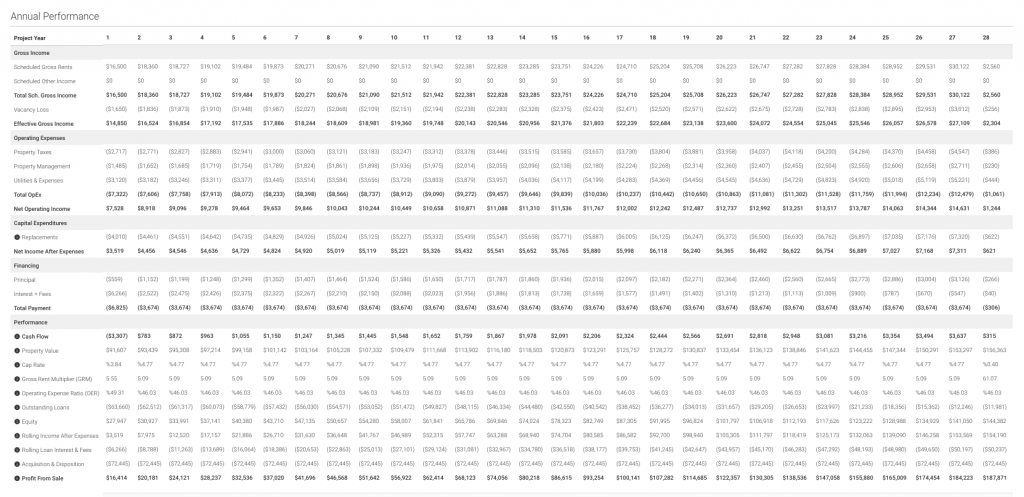

The other day I was thinking about how we use Cash on Cash Return (CCR) to filter and compare potential rental property investments, and how that metric is only useful to understand the first year performance of a potential long-term buy-and-hold deal. This post explains the limitation of Cash on Cash Return (CCR) beyond the first year, and why you should use Internal Rate of Return (IRR) to analyze the long-term potential of your rental property investments instead. Starting at the Beginning: What is ROI? ROI is the rate of return of your total investment. Generally, ROI is used for short-term investments such as flips where you… Read More

Continue Reading