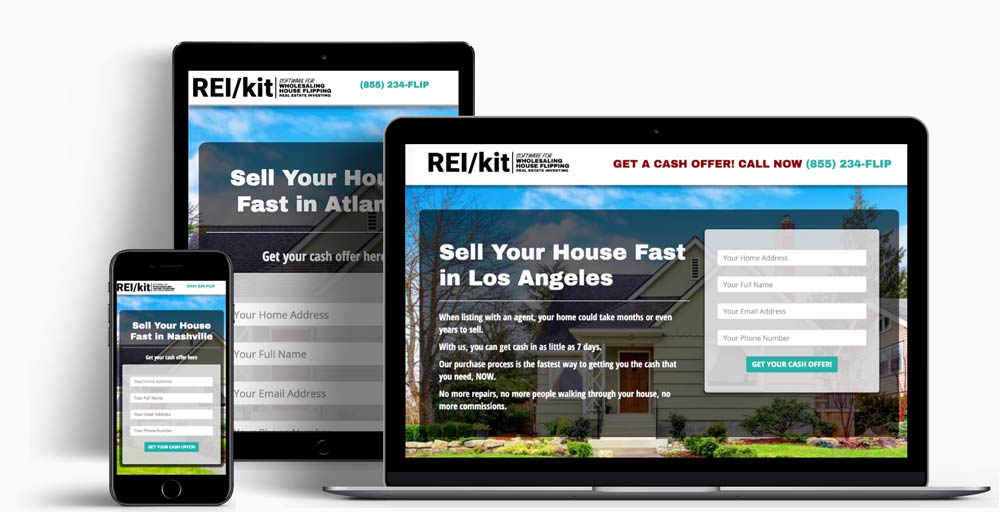

You’ve probably been getting inundated with news about ChatGPT from all directions; I’ve certainly been talking about it often enough with REI/kit’s ChatGPT integration! It is because I believe so strongly in what it can help you accomplish, that today I want to step back and give you a taste of WHY you should care about this powerful tool, and how it can truly benefit your real estate wholesaling business, even if you don’t use it with REI/kit real estate wholesaling software (which of course you should). ChatGPT is an extremely powerful tool created by OpenAI that understands and generates human-like text based on the input it receives. It’s like… Read More

Continue Reading